ABOUT US

OVERSHIELD Avocats is an independent law firm assisting both French and foreign clients with international tax issues and business litigation.

Our team of experienced attorneys is dedicated to providing high-end legal services to companies, high-net-worth individuals and top executives, wealth managers, banks, family offices, or human resources departments of international groups.

We implement our experience and know-how in order to anticipate the needs of our French and international clients and provide a swift, practical, and personalized response to their legal and tax concerns.

We believe that every client is unique and we approach each case with a fresh eye. We take the time to understand our clients’ goals and concerns, and we work closely to offer customized solutions.

Our team speaks French, English, Russian, Italian, and German.

WELL-KNOWN EXPERTISE

We are a boutique firm consisting of 3 partners who have worked for over 10 years in internationally renowned law firms. The combination of our experience and our know-how in international taxation and litigation builds the spirit and strength of OVERSHIELD Avocats.

BOUTIQUE LAW FIRM

We believe in building strong relationships with our clients based on trust and transparency. We take the time to discuss your concerns, answer your questions, and work with you to develop the best possible solutions for your tax and legal issues.

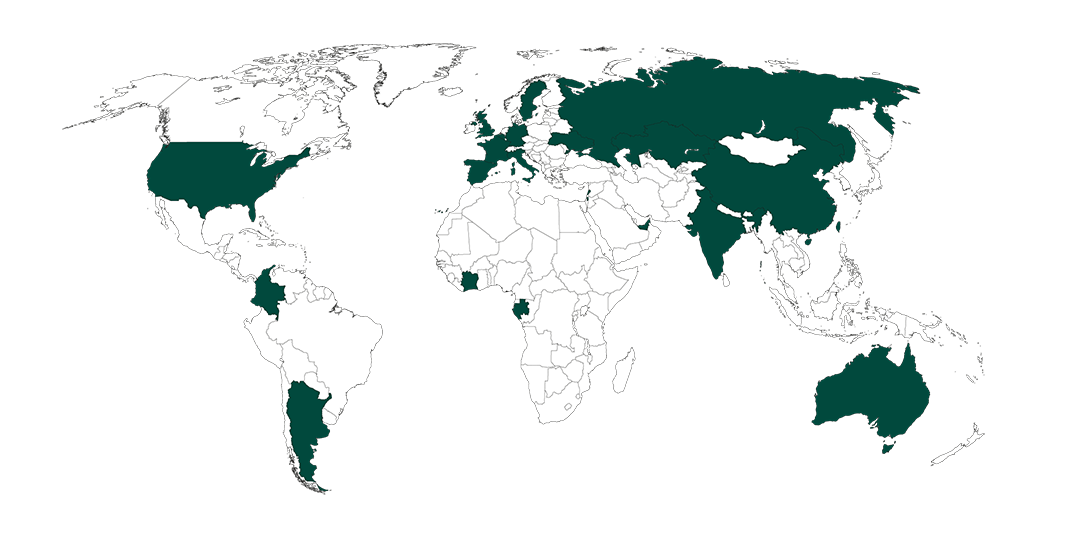

NETWORK OF INTERNATIONAL PARTNERS

The experience of each one allows us to rely on the expertise of international advisors with whom we have built a wide multi-disciplinary network and strong relationships in order to assist you in your cross-border transactions.

ANSWERS ADAPTED TO YOUR NEEDS

We aim to offer tailor-made assistance for your long-term projects at an international level. Our specialists will provide you with personalised solutions and a strategic overview on complex issues.

THE TEAM

Our goal is to provide you with the guidance and support you need to navigate complex tax laws and regulations. We pride ourselves on delivering personalized assistance to each of our clients, ensuring that your unique needs and circumstances are met with tailored solutions.

Our team consists of skilled attorneys with extensive experience in all areas of tax law (including income tax, wealth tax, estate tax, gift tax, etc.) as well as business litigation. We keep abreast of the latest developments in tax law and litigation and use that knowledge to provide innovative and effective strategies to our clients.

OUR CLIENTS

TAX EXPERTISE

WEALTH OPTIMISATION

REAL ESTATE

INTERNATIONAL MOBILITY

GIFT & ESTATE STRATEGIES

REPORTING OBLIGATIONS

TAX AUDIT & LITIGATION

FRANCE-MONACO EXPERTISE

FRANCE-UK EXPERTISE

TRUSTS

TAXATION OF ART

TAXATION OF ARTISTS & ATHLETES

FOUNDATIONS AND ASSOCIATIONS – NON-PROFIT ORGANIZATIONS

DISPUTE RESOLUTION

CIVIL AND COMMERCIAL

LITIGATION

STOCK MARKET AND FINANCIAL

LITIGATION

STATUTORY AUDITORS AND

ACCOUNTANTS

CORPORATE AND EXECUTIVE LAW

LITIGATION

REAL ESTATE LAW

ENFORCEMENT PROCEDURES

CONTACT

WEALTH OPTIMISATION

OVERSHIELD Avocats offers integrated services, providing long-term thinking and short-term responsiveness in multi-jurisdictional tax and legal planning.

Our typical services are as follows:

- Tax residence or domicile issues, treaty optimization mechanisms, tax aspects related to departure or return to France (exit tax, income tax, social security contributions, etc.);

- Advice (including due diligence) for family offices or private clients or managers for the application of the latest legal and tax techniques;

- Planning the acquisition or disposal of real estate assets, organizing the holding of real estate, aspects related to the taxation of capital gains on real estate, etc.;

- Assistance and tax planning in relation to wealth tax and 3% tax;

- Planning the transfer of assets inter vivos or in case of succession.

REAL ESTATE

OVERSHIELD Avocats assists its clients in all legal and tax aspects of their acquisition, transfer,(re)financing or real estate restructuring projects.

We act on behalf of our resident and non-resident clients for the management and reorganization of their assets and in particular the direct or indirect ownership of real estate, be they residential buildings, vineyards, chalets or hotels. We monitor these projects alongside our clients and other parties (banks, notaries, etc.) and we provide tailor-made advice on the tax treatment of property income or capital gains.

We can deal with the complexities of real estate transactions while keeping a keen eye on the clients’ long-term goals.

We also act as a real estate agent-attorney to assist you in the strategy and sale of your real estate properties.

INTERNATIONAL MOBILITY

OVERSHIELD Avocats regularly assists its clients with their international mobility projects in order to provide them with the best possible support in relation to the professional and personal aspects of their mobility.

- International professional mobility:

We assist employees and employers in the application of complex tax regimes related to expatriation and impatriation, the organization of their international remuneration – inter alia split-payrolls, compensation and benefit schemes, the implementation and management of stock option and free share plans, as well as pension plans in an international context.

- Personal international mobility:

On a personal level, we help our clients secure, from tax standpoint, their arrival in or departure from France. We advise them in particular on the management of tax residency conflicts, exit tax issues, taxation of their French source income abroad or their foreign source income when they move to France.

GIFT AND ESTATE STRATEGIES

Planning for the succession of your estate in a tax-efficient way is a major issue for many of our clients as they look to provide for future generations or for the causes they support.

OVERSHIELD Avocats focuses on delivering high-expertise services, whether tax or legal in a domestic or cross-border context while preserving the ultimate family objectives of the client.

At every stage of the preparation, and administration of an estate, our attorneys are attuned to available planning opportunities to foster our clients’ interests. OVERSHIELD Avocats successfully represented clients in various types of estate litigation and complex tax and legal audits and/or court proceedings.

Typical services rendered include:

- Wealth transfer, strategies aimed at reducing taxes on inheritance, gift, income and capital gains;

- Settlement of estates in a cross-border context in coordination with foreign counsels;

- Conflicts of law – French inheritance law;

- Enforcement of foreign trusts and wills in France;

- Preparation and drafting of French wills, assistance in disputes relating to wills and trusts.

REPORTING OBLIGATIONS

OVERSHIELD Avocats provides assistance to resident and non-resident clients as regards their French tax returns and in particular:

- Individual income tax (“IRPP”) and real estate wealth tax (“IFI”) returns;

- Tax returns related to the on the market value of real estate (“TVVI” – “3% Tax”);

- Exit-tax returns;

- Declarations relating to SCIs and in particular the 2072 returns;

- Reporting obligations related to Trusts;

- Gift and Estate tax returns.

We also assist our client in the context of tax regularization procedures.

TAX AUDIT AND LITIGATION

OVERSHIELD Avocats assists individual and corporate clients in their relations with the tax authorities, whatever the tax involved (income tax or capital gains tax, wealth tax, registration duties, 3% tax, etc.). Our expertise enables us to understand the risks faced by our clients and to adapt the litigation strategy and the defense of their interests and goals accordingly:

- Upstream, risk identification, and management: risk analysis of the file and assistance in responding to requests from the administration;

- During the tax audit phase: representation of our clients throughout the procedure and development of a strategy to preserve their rights and reach the best result. Negotiation with the tax authorities and referral to the relevant committees and interlocutors;

- If necessary, resort to litigation: development of a litigation strategy and implementation of the necessary procedures, up to the supreme courts. The procedures may concern the calculation of the tax but also the challenge of the tax legislation with regard to the Constitution or supra-national texts;

- Management of collection procedures: implementation of deferred payment and settlement plans. Challenging forced collection measures taken by the tax authorities and procedures for the accelerated settlement of debts by the Treasury.

FRANCE-MONACO EXPERTISE

Many years of service to clients and partners established in the Principality of Monaco have allowed us to develop extensive expertise in Monegasque legal and tax matters.

We regularly advise on:

- Tax residence or domicile issues, tax treaties optimization mechanisms;

- Advice (including due diligence) for family offices and companies operating from Monaco;

- Real estate acquisition or disposal planning, control retained ownership transmission, shareholding and capital gain sharing organization, registration duties;

- Restructuring and transfer of assets;

- Taxation in the Franco-Monegasque context (inter alia application of tax treaties, specific exemptions related to residence in Monaco with regard to income from French sources or wealth, etc.).

FRANCE-UK EXPERTISE

We have developed a high value-added expertise in France-UK transactions:

- Transfers of domicile between the two countries and the application of treaty rules under the “remittance basis” regime;

- Planning the acquisition or disposal of real estate, organizing the holding of real estate via companies or trusts;

- Setting-up structures in France (subsidiary or branch) for asset management companies or funds initially located in the UK, and securing an optimal arrival in France of their managers;

- Estate planning and transmission of assets in a particularly complex France-UK context due to the difference in tax rules between the two countries (life interest trust and the impossibility of split of ownership, rules relating to life insurance, non-recognition of the tax transparency of French SCIs, etc.).

TRUSTS

OVERSHIELD Avocats has significant experience with Trusts in the context of international transactions. We are regularly requested to advise trustees, beneficiaries or settlors domiciled in France on matters such as:

- Estate planning and the application of international tax treaties on succession in the presence of trusts;

- Assistance to French residents having ties with foreign trusts and their reporting obligations;

- Tax treatment of the distribution of income or capital by navigating the uncertainties involved in these mechanisms, which are not well known in French civil and tax law;

- The holding of real estate located in France via foreign trusts and the consequences in terms of French Wealth Tax (“IFI”) or sui generis levy.

TAXATION OF ART

Besides the passion of buying an artwork, there are legal and regulatory aspects that must be taken into consideration, especially regarding taxation. OVERSHIELD Avocats has a deep understanding of the art market and developed expertise in tax matters related to the acquisition and disposal of works of art.

We provide practical solutions on tax and legal matters including the creation of holding vehicles such as foundations or corporations, but we also advise on anticipating inheritance tax issues.

We are solicited by collectors, art galleries, artists, private and public foundations and museums in a national and international context.

TAXATION OF ARTISTS AND ATHLETES

OVERSHIELD Avocats assists clients in the following areas:

- Tax treatment of remuneration received directly or via intermediary companies: copyright, image rights, neighboring rights, fees, compensation obtained in the context of litigation, etc.

- Management of the arrival in France: impatriate regime, review of the structuring of the remuneration…

- Formalities related to departure from France: determination of tax residence, Exit-Tax, etc..

FOUNDATIONS AND ASSOCIATIONS – NON-PROFIT ORGANIZATIONS

With extensive experience in the non-profit sector, we assist our individual clients who wish to make donations to non-profit organizations located in France or abroad.

We also act for non-profit organizations and provide tailor-made advice to the management of their activity and related tax risks. Although the restrictions relating to the location of the non-profit organization tend to disappear, the differences in tax treatment are significant when the organization is located outside of France.

CIVIL AND COMMERCIAL LITIGATION

Combining legal expertise, understanding of strategic issues and knowledge of jurisdictions, OVERSHIELD Avocats has significant expertise in complex litigation involving various legal fields.

The firm seeks the most suitable solution to the resolution of the dispute by favoring a pragmatic approach guided by the interests of the client.

OVERSHIELD Avocats assists its clients at all stages of their disputes relating to the performance of contracts, breach of contract and negotiation, actions relating to unfair competition, denigration, sale of business litigation, ex parte proceedings, and litigation relating to the termination of established commercial relationships.

STOCK MARKET AND FINANCIAL LITIGATION

OVERSHIELD Avocats is regularly involved in stock market and financial litigation involving financial players and, in particular, in the liability of asset management advisors and financial investment advisors, in disciplinary litigation (AMF investigation and control proceedings; proceedings before the AMF enforcement Commission), in financial services litigation and prudential litigation and assists its clients with the preparation of compliance manuals and rules of conduct.

STATUTORY AUDITORS AND ACCOUNTANTS

We assist our clients in the litigation of auditors and chartered accountants before civil, commercial and disciplinary courts.

CORPORATE AND EXECUTIVE LAW LITIGATION

OVERSHIELD Avocats offers its expertise and experience to its clients in all types of acquisition litigation: representation and warranties agreement, price revision clauses, etc., litigation related to the exclusion of shareholders, disputes related to the dismissal of directors, conflicts between shareholders.

REAL ESTATE LAW

OVERSHIELD Avocats assists its clients with all of their commercial and professional issues, residential leases (litigation for eviction of tenants due to unpaid rent, vacancy notices, etc; litigation of disturbances and deprivations of use, litigation of abnormal neighborhood disturbances), works, construction and urban planning (liability action against architects and contractors), joint ownership issues (litigation of enjoyment and management of joint property; distribution of expenses; litigation of exit from joint ownership), real estate sales (litigation of the promise to sell; compulsory execution; defects of consent).

ENFORCEMENT PROCEDURES

Our team has developed a specific expertise in « enforcement procedures » to assist you upstream or in the implementation of court decisions.

Mindful of what is at stake for our clients, we have developed this critically important practice according to a simple philosophy: without enforcement, a court decision is of no value.

From the implementation of precautionary measures, through the follow-up and litigation of enforcement measures, to the enforcement of decisions issued by any court, our lawyers combine expertise and technicality to advise you and ensure the success of legal proceedings.

JÉRÔME BARZUN

FOUNDING PARTNER

BUSINESS LITIGATION

j.barzun@overshield-avocats.com

+33620376797

9-11 rue Anatole de la Forge,

75017 Paris

Jérôme Barzun is an experienced lawyer in litigation, in particular in business law litigation.

Prior to founding the firm, he practiced for over 15 years with the international business firms Latham & Watkins and Paul Hastings and then with his own law Firm.

Jérôme Barzun graduated from Sciences Po Paris (economics and finance) and holds a DESS in Business and Tax law from the University of Paris II Panthéon-Assas. He obtained the certificate of aptitude for the legal profession after being distinguished in the exit classification.

He is a member of the French Union of Economic Intelligence and of the Sciences Po Alumni association.

He is fluent in English and French.

Jérôme Barzun is registered at the Paris Bar.

XENIA LORDKIPANIDZÉ

FOUNDING PARTNER

INTERNATIONAL TAXATION

xlo@overshield-avocats.com

+33772771617

9-11 rue Anatole de la Forge,

75017 Paris

Xenia Lordkipanidzé has extensive experience in international taxation of individuals (territoriality, application of tax treaties, exchange of information, income and wealth taxation, estate planning, real estate taxation, transfer of residence, international mobility of employees, trusts, …) and property law. She also assists her clients in tax disputes.

Xenia Lordkipanidzé has also developed an expertise in Monegasque corporate law and tax legislation (transfer of residence of individuals and setting-up of companies in Monaco, taxation of French citizens residing in Monaco, estate planning, employee benefits, real estate acquisitions).

She founded TAXWISE Avocats in 2018, which became SHIELD Avocats in 2023, after having worked for 15 years in the International department of CMS Bureau Francis Lefebvre (2003-2018). She previously worked in the tax department of the Paris office of Latham & Watkins (2000-2003).

She is a member of the IACF (Institut Français des Conseillers Fiscaux), the IFA (International Fiscal Association) and the IBA (International Bar Association).

Author of numerous articles, among others in the Transfer Pricing Journal and Option Finance, and regularly speaks at seminars and conferences related to wealth taxation (trusts, comparative taxation of individuals, exchange of information, Monegasque taxation).

She is fluent in French, English and Russian.

ADEA MEIDANI

FOUNDING PARTNER

INTERNATIONAL TAXATION

a.meidani@overshield-avocats.com

+33646354156

9-11 rue Anatole de la Forge,

75017 Paris

Adea Meidani advises and litigates in matters involving international tax issues, such as: wealth and estate planning, real estate restructuring and refinancing, cross-border transactions, transfer of domicile or seat. She advised on complex inheritance disputes and assisted clients in settlement agreements in a cross-jurisdictional context.

She co-founded OVERSHIELD Avocats in 2023 after having worked with CMS Francis Lefebvre for 13 years. She previously worked for Morgan, Lewis & Bockius LLP in Paris (2007-2008) and an oil and gas company, EDF Trading, in London (2008-2009).

She is a member of the IACF (Institut Français des Conseillers Fiscaux), the IFA (International Fiscal Association), the IBA (International Bar Association) and STEP (Society of Trust and Estate Practitioners).

Author of numerous articles, among others on trust matters, France-UK international transactions, real estate restructuring, charity and cross border donations, and taxation of art.

She is fluent in French, English, Italian and proficient in German.

CAROLE DARBÈS

ASSOCIATE

INTERNATIONAL TAXATION

c.darbes@overshield-avocats.com

+33674503363

9-11 rue Anatole de la Forge,

75017 Paris

Carole Darbès joined OVERSHIELD Avocats in September 2023. She is a tax lawyer specialized in international taxation. She advises individuals and companies on national and international tax matters.

She has developed an extensive expertise in matters relating to wealth planning (among others, real estate wealth tax), real estate restructuring and refinancing operations, as well as international estate taxation and tax residency determination.

She has good practice in advising German clients.

Carole Darbès gathered professionnal expérience at international law firms such as EY (2018), Pinsent Masons (2020) and CMS Bureau Francis Lefebvre (2021). Prior to joining OVERSHIELD Avocats, she was head of the legal and tax department of PKF Arsilon (2021-2023).

Carole Darbès is a graduate of the University of Paris II – Panthéon ASSAS and Paris X – Nanterre. She is fluent in French, English and German.

CLÉMENT PÉRÉ

ASSOCIATE

INTERNATIONAL TAXATION

c.pere@overshield-avocats.com

+33183640981

9-11 rue Anatole de la Forge,

75017 Paris

Argentina

Australia

Belgium

Brazil

China

Colombia

Emirates

France

Gabon

Germany

Greece

India

Israel

Italy

Ivory Coast

Kazakhstan

Lebanon

Mauritius

Monaco

Morocco

Portugal

Republic of Congo

Russia

Saudi Arabia

Spain

Sweden

Switzerland

Taïwan

Ukraine

United Kingdom

United States